Kineko dApp: How It Works

The Kineko Exchange is a fully-licensed high throughput bookmaker focused on Sports and eSports betting. Users are just a few clicks away from placing a bet in either our native $KKO token or many other supported cryptocurrencies.

Introduction

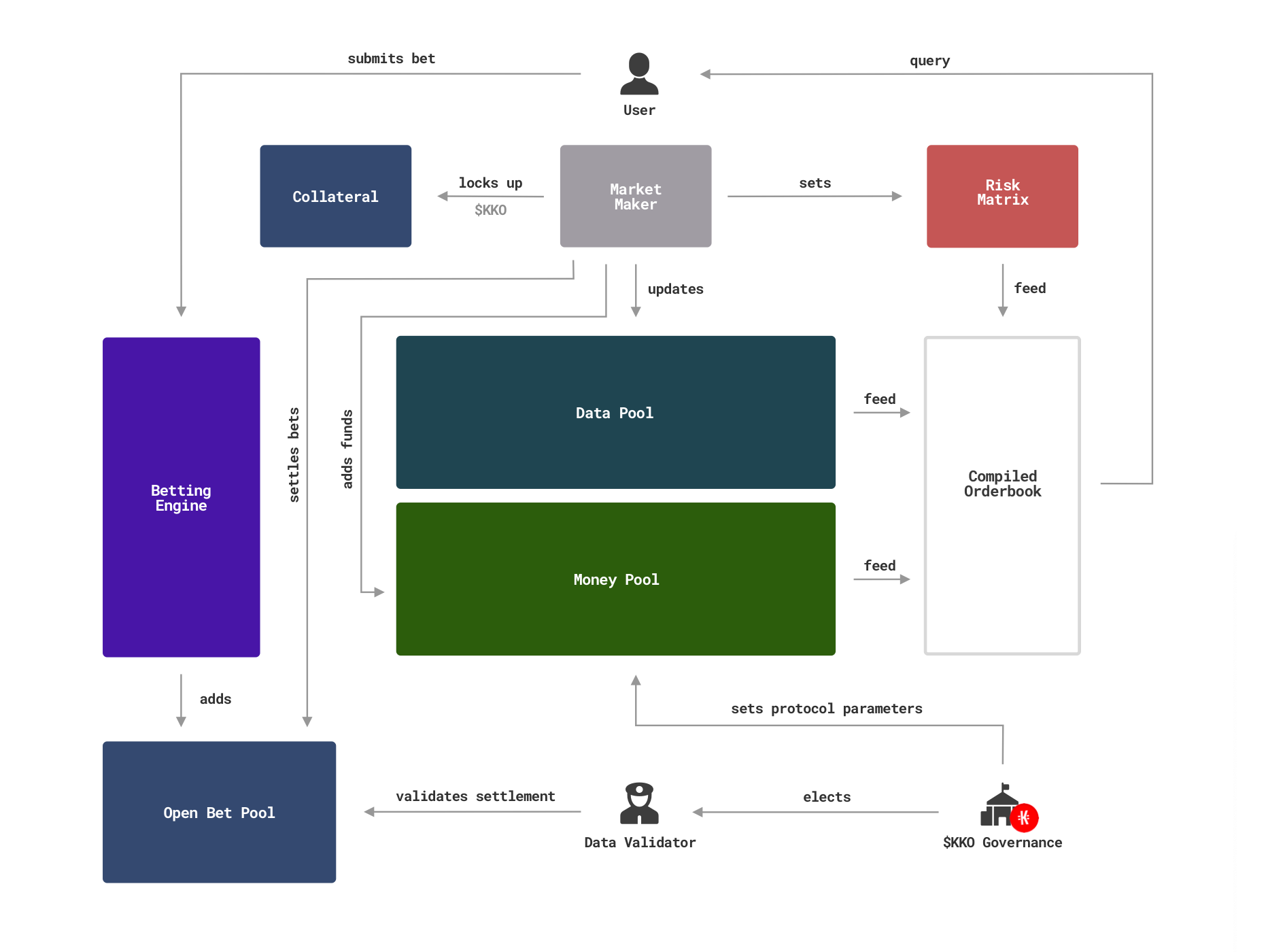

Betting markets work in essentially the same way as a trading market. In order to facilitate a bet or a trade there needs to be two parties, each holding one side of the contract. One side of the bet supplies the liquidity (the maker) and the other side of the bet will receive the liquidity when certain underlying conditions are met (the taker). The main difference between trading and sports betting is that the ratio of number of makers to number of takers is far more asymmetric in the case of sports betting and therefore requires different protocol architecture. Kineko aims to supply this to users by using a decentralized, user-focused solution without compromising on the liquidity and ease-of-access that a centralized platform would supply. These key factors are what distinguish Kineko from other decentralized betting platforms that have struggled to become mass-adopted.

Governance and the $KKO token

As a decentralized user-driven bookmaker, governance plays an important role in establishing the parameters that Market Makers and Takers must follow. Governance will also decide upon things like distribution of rewards and development milestones. The $KKO token plays an important role in decentralized governance of the protocol allowing holders to voice their opinions on these topics while receiving a share of the protocol’s profits. The $KKO token will be split up amongst the community, the DAO, and the developers with an exceptionally large portion of the token being released as rewards for staking liquidity into the protocol.

Kineko Protocol Dynamics

The heart of the Kineko protocol is the relationship between Makers and Takers, with the Makers filling the important role of creating events/markets/outcomes and offering odds to the Takers. Potential Kineko Market Makers (MM) require fulfilling two criteria before becoming recognized as a MM:

- A minimum amount of liquidity must be placed into the Money Pool.

- Must stake $KKO tokens as collateral which can be frozen/burned once fraudulent behavior is determined by Governance and a “guilty” verdict is decided.

Market Makers hold their funds in a segregated Money Pool (MP) where they can use the funds to create betting markets, deciding upon the odds themselves. This creates a betting economy where the Market Makers are competing amongst each other through odds-priority, resulting in fair and competitive betting for the Takers.

Market Makers are also required to push their own Risk Matrix (RM) to the protocol which acts as a filter for their market-making parameters. This Risk Matrix offers MMs the ability to visualize how much risk they will be taking on, controlling the maximum amount of liquidity per bet that they should follow to align with their Market Making Strategy.

The End-User

Kineko is geared to be as user-friendly as possible despite being composed of complex Ethereum contracts on the back-end. Users can evaluate active events, markets, outcomes and odds and choose their bets all from a familiar, simple to use UI. Our Matching Engine makes this possible by ensuring that the bets users make are acceptable and the payouts are accessible.

The Matching Engine (ME) allows users to place single, or multiple bets where odds can be multiplied for higher potential payouts. These ‘single’ and ‘multiple’ bet types represent the Bet Slip types. The Matching Engine analyzes the bet that users create and settle the bets through Data Validators (elected through Governance) where the winnings are pulled from Market Maker’s Money Pools.

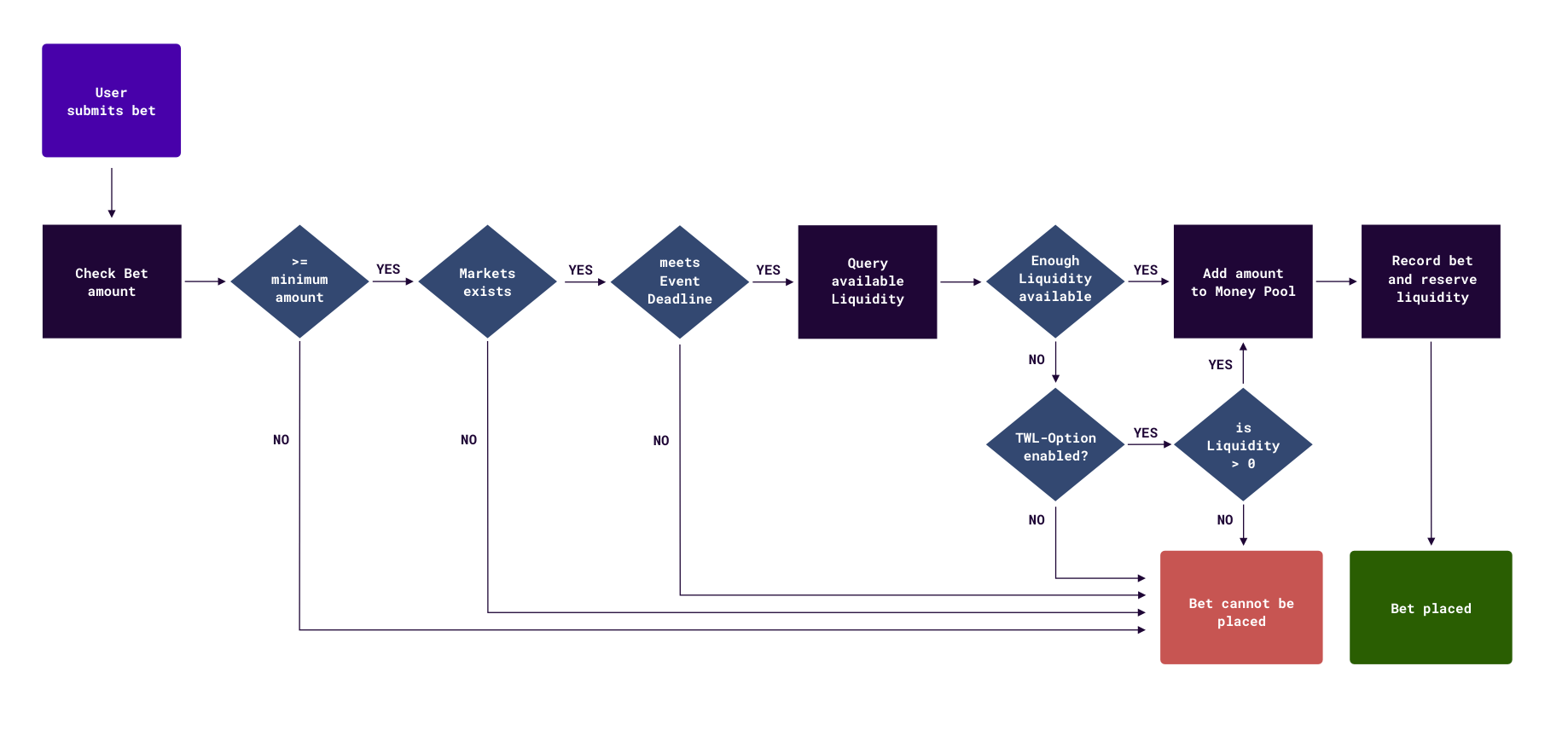

The Matching Engine uses the following modus operandi when settling bets:

1. Check if the amount is greater or equal the minimum bet amount

2. Verify if the outcome identifier(s) exist(s) and is tied to a valid and active event and market

3. Check if current time is less than Event Bet Deadline

4. Query Risk Matrices of Liquidity Providers and get available liquidity

5. Filter available liquidity with maximum acceptable quote set in request

6. Check requested bet amount against filtered liquidity. Accept if filtered liquidity is sufficient or TWL-option (Take-What‘s-Left) is enabled

7. Add amount to Money Pool

8. Record bet and reserve liquidity for potential payout

The Matching Engine offers seamless user experience for bettors to ensure that liquidity is available for the bets offered on the Kineko platform, reserving the liquidity in the money pool for when the bet needs to be settled. Pairing the Matching Engine with our incentives for Market Makers and ensuring that offered bets stay competitive, we hope to offer the best sports betting experience possible; all the while earning yield and governing the platform using the principles of decentralized finance.

Website: https://stake.kineko.io

Casino: https://kineko.com

Twitter: https://twitter.com/KinekoDefi

Telegram Public: https://t.me/KinekoDefi

Telegram Announcements: https://t.me/KinekoAnnouncements

Discord: https://discord.gg/kineko